« David Foster Wallace | Main | Al borde del precipicio »

Septiembre 15, 2008

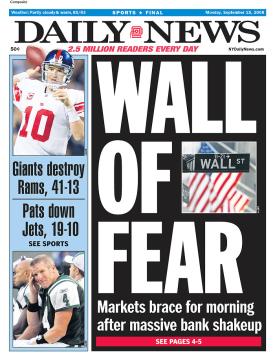

El hundimiento de las catedrales de Wall Street

Miedo y avaricia, la mezcla que ha estallado en Wall Street:

Fear and greed are the stuff that Wall Street is made of. But inside the great banking houses, those high temples of capitalism, fear came to the fore this weekend.

Will the U.S. financial system collapse today, or maybe over the next few days? I don’t think so — but I’m nowhere near certain. You see, Lehman Brothers, a major investment bank, is apparently about to go under. And nobody knows what will happen next.

El fin de una era:

It’s the end of an era for Merrill Lynch, the brokerage firm that brought Wall Street to Main Street.

Esta vez no hubo rescate porque la Administración norteamericana no podía financiar la compra de Lehman. Y los bancos no estaban por la labor de poner en riesgo su futuro sin saber dónde se estaban metiendo.

With little time to inspect Lehman’s toxic assets, Barclays and Bank of America made it clear that any deal would be contingent on them receiving government agreeing to absorb a portion of the losses. The government had committed about $30 billion to supporting JPMorgan Chase’s emergency takeover of Bear Stearns and just last weekend put up $200 billion in its rescue of Fannie Mae and Freddie Mac.But fearing they had created a moral hazard and already pushing its budget, Mr. Paulson and Mr. Geithner were adamant that the government would not participate in a bailout. With all sides digging in their heels, one thing was clear: Lehman was, as one participant at the meeting put it, a “Dead Bank Walking.”

En el artículo del NYT que comienza con un nada alentador "In one of the most dramatic days in Wall Street’s history...", también anotan los problemas del gigante de los seguros American International Group:

Staggered by losses stemming from the credit crisis, A.I.G. sought a $40 billion lifeline from the Federal Reserve, without which the company may have only days to survive.

¿Días?

----

17.00

Wall Street abrió por la mañana perdiendo 300 puntos (un 4%) en diez minutos. Luego se recuperó hasta una pérdida de 250 (un 2,2%). A las Bolsas europeas les está yendo peor. El Banco Central Europeo ha enchufado 30.000 millones de euros en el sistema para que no se venga abajo.

----

17.30

El sueldo del consejero delegado de Lehman Brothers, Richard Fuld, alias 'el gorila':

Lehman's fall from grace was brutally fast. Until June, it had never even reported a quarterly loss as a public company. As recently as March, Fuld was awarded a $22 million bonus for 2007 -- a generous pay package to be sure, but one that also reflected a year in which the bank's net profit had risen 5 percent to a record $4.2 billion.----

17.50

McCain imita a Solbes: los fundamentos de la economía son sólidos.

----

20.30

Otro buen relato de la crisis y de las reuniones en que el Tesoro norteamericano y la Reserva Federal negociaron con las grandes entidades financieras un posible rescate de Lehman:

One person in the Fed meetings Saturday night described them as "the world's biggest game of poker."

Posted by Iñigo at Septiembre 15, 2008 01:16 PM

Trackback Pings

TrackBack URL for this entry:

http://www.escolar.net/cgibin/MT/mt-tb.cgi/10215

Comments

Una casualidad que ayer estuviese viendo un curioso y didactico video sobre la creación del dinero y sus entresijos bancarios.

En inglés:

http://video.google.es/videoplay?docid=-9050474362583451279&ei=6IDOSPOYCYmwiAK00oi6Ag&q=money+as+debt

En castellano:

http://video.google.es/videoplay?docid=-2882126416932219790&ei=2IDOSLnHO4vEiALun_DAAg&q=dinero+es+deuda

Posted by: SkyNet! at Septiembre 15, 2008 05:46 PM

Here:

http://www.cato-at-liberty.org/2008/09/08/not-a-market-failure/

"Fannie and Freddie: Socialist from the Start" por Edward H. Crane do Cato Institute:

.... when I hear talking heads on TV this morning claiming socialism is alive and well in America by virtue of the federal takeover of Fannie and Freddie, I think, please, Fannie and Freddie have always been socialist institutions. This is not a market failure as so many are now claiming. It is a government failure, pure and simple.

and here:

http://www.lewrockwell.com/rockwell/fascist-creations-fdr.html

"Fannie, Freddie, Fascist" por Lew Rockwell:

They were created by FDR in 1938 to fund mortgages insured by the Federal Home Administration. They were used by every president as a means to achieve this peculiar American value that every last person must own a home, no matter what.

In other words, we are not talking about market failure .... They occupy a .... status for which there is a name: fascism. Really, that's what we are talking about: the inexorable tendency of financial fascism to mutate into full-scale financial socialism and therefore bankruptcy.

Posted by: Phil at Septiembre 16, 2008 01:44 AM

Sobre el mito de la no regulación del mercado:

Too Few Regulations? No, Just Ineffective Ones

http://www.nytimes.com/2008/09/14/business/14view.html?_r=3&ref=business&oref=slogin&oref=slogin&oref=slogin

Posted by: Phil at Septiembre 16, 2008 07:26 PM